ANSWERS BY JAMES J. GREENBERGER TO SUPPLEMENTAL QUESTIONS FROM

U.S. SENATE COMMITTEE ON ENVIRONMENT AND PUBLIC WORKS

August 19, 2019

Chairman Barrasso:

1. Looking forward, what can we learn from the successes of lead-acid battery recycling if we were to apply a similar framework to lithium-ion batteries?

Efforts to recycle lead-acid batteries, particularly those used as SLI (starter, lighting and ignition) batteries in automobiles, have been very successful. Approximately 95-98% of automotive SLI batteries are recovered, recycled and used again in the production of new lead-acid batteries. It is important to note, however, that there have been serious environmental problems associated with lead-acid battery recycling.

Some important differences exist between recycling lead-acid SLI batteries and lithium-ion batteries, which point to greater challenges, though lesser risks, involved in recycling lithium-ion batteries.

The first difference is that the value of the lead metal produced by recycling lead acid batteries is generally greater than the cost of collecting and recycling the lead acid batteries themselves. This permits recyclers to pay to acquire used lead-acid batteries for recycling. This payment is a “pull signal” in the market that results in a high percentage of lead acid batteries being collected and delivered to recyclers for recycling. It is the single most important factor that accounts for the high lead-acid battery recycling rate.

Unfortunately, lithium-ion chemistry is not as favorably disposed to the economics of recycling as is lead-acid chemistry. Although lithium-ion battery cells contain some valuable base metals—lithium, copper, graphite, nickel and, especially, cobalt—those base metals exist in relatively small amounts in a lithium-ion battery cell. Today no recycler in the United States can recover the costs of collecting and recycling used lithium-ion batteries from the value of the base metals that the recycling those batteries produces. Recycling lithium-ion batteries requires the payment of a fee (often called a tipping fee) to a recycler to do the recycling, unlike lead-acid battery recyclers, who will pay for the opportunity to recycle.

One of the great challenges of lithium-ion battery recycling is how to make the process of lithium-ion battery recycling profitable, so that lithium-ion battery recyclers can pay for batteries to recycle in the same way that lead acid recyclers can. Several companies and research institutions, including the ReCell Center recently established by the U.S. Department of Energy, are working on generating fully formed cathode materials for batteries directly from a recycling process, rather than just base metals. It is hoped that the value of the fully formed cathode materials produced by this “direct recycling” process will be substantially higher than the value of base metals produced by traditional recycling processes. If so it may be possible for recyclers to generate a profit from recycling lithium-ion batteries and pay to acquire discarded lithium-ion batteries in the market.

Direct recycling technology today, however, exists only at the lab scale. Scientific and economic challenges to the process remain and there is no assurance that it will ever be economically successful at scale. But if it is successful, direct recycling technology may cause the lithium-ion battery recycling problem to essentially take care of itself, much in the way that lead-acid battery recycling has.

The second difference between lead-acid batteries and lithium-ion batteries is that lead-acid SLI batteries are relatively uniform in size, shape and chemistry. Lithium-ion automotive batteries, on the other hand, differ substantially from manufacturer to manufacturer and from auto maker to auto maker in size, shape and chemical composition. The consistency of lead-acid batteries makes them easy and cheap to disassemble and recycle at scale. The inconsistencies among lithium-ion batteries, which are often not readily apparent from the outside packaging, add time and cost to the lithium-ion battery recycling process.

The consistency of lead-acid batteries and the inconsistency of lithium-ion batteries is a function of their relative states of technological maturity. Lead-acid technology was first developed in 1859 and has been refined ever since into batteries that are now ubiquitous in automotive and industrial applications and relatively uniform. In contrast, the first lithium-ion battery was sold only in 1991. Lithium-ion technology continues to evolve with different manufacturers experimenting with, and seeking competitive advantage from, different designs, form factors and chemistries of lithium-ion batteries. Lithium-ion technology continues to improve at a rapid rate, with lithium-ion automotive batteries gaining in energy density and falling in price at the rate of about 8%-12% per year over the last 10 years.

While uniformity of lithium-ion batteries would reduce the cost of their recycling, requiring that uniformity today would stifle innovation in lithium-ion technology at an important stage of its development. But the design and manufacture of lithium-ion batteries with a view to ease of recycling should be encouraged. This does not occur now because there is currently no market incentive for manufacturers to make lithium-ion batteries more uniform or easy to recycle. Regulators wishing to encourage or mandate recycling should consider rating lithium-ion automotive batteries according to the relative ease with which they can be disassembled and recycled. Lower rated batteries might be assessed a higher disposal fee at the time they are put into service. This would encourage battery manufacturers and auto makers to consider the ultimate costs of recycling when designing lithium-ion batteries in a way that they do not have to today.

The third difference between lead-acid recycling and lithium-ion battery recycling is the environmental impact of the recycling process itself. Lead is a toxic material. Handling and processing lead metal in large quantities involves potential health risks. While these risks can be adequately managed by lead-acid battery recyclers, accidents and poor practices can and have occurred with tragic consequences for workers and communities.[1]

In comparison to lead-acid batteries, lithium-ion batteries are relatively environmentally benign. Although the electrolytes in most lithium-ion batteries contain small amounts of toxic halogens, the mass of a lithium-ion battery is largely free of environmentally hazardous materials. Recycling lithium-ion batteries should pose little threat to the environment. So while lithium-ion will struggle to achieve the recycling efficiency of lead acid batteries, there will be substantial environmental benefit in having recyclers transition from the recycling of lead-acid batteries to the recycling of lithium-ion batteries.

2. In your written testimony, you talk about the need for a national policy to address lithium-ion battery recycling. You mention that inconsistent requirements across the country could increase the cost of recycling to consumers. Can you explain why preemption of state policies would drive down recycling costs?

Responsible manufacturers and recyclers can live with any reasonable regulation of lithium-ion battery recycling—so long as they only have to live with it once. There are many different systems that legislators could consider to ensure the proper recycling of lithium-ion batteries: extended producer responsibility, municipal recycling programs, partnerships between industry and NGO’s, landfill surcharges or bans, and mandatory take-back programs. Each of those systems involves a cost that will ultimately be borne by purchases of electric vehicles.

Industry’s fear is that high recycling costs, when added to the price of electric vehicles, will depress demand and make the transition to electric drive less popular. Complying with multiple and potentially inconsistent recycling regulations in multiple jurisdictions will only add to the costs of recycling. It is important that recycling costs remain as low as possible. Complying with only a single set of regulations will help keep those costs down.

Also, recycling lithium-ion batteries is more appropriately a federal rather than a state concern. The reason why regulators should be interested in recycling lithium-ion batteries has less to do with local issues of health and safety, such as vehicle emissions and disposal of toxic chemicals, than with larger, national issues, such as greenhouse gas emission reduction and control of strategic energy materials. The case for national regulation of lithium-ion battery recycling is better than for the regulation of other automobile-related hazards, which are traditionally the subject of state and local regulation.

The best interests of industry and consumers would be served by enacting a single system for recycling lithium-ion automotive batteries on the national level. Given the regional nature of the North American automobile industry, coordinating any national standards enacted in the United States with Canada and Mexico would have additional cost saving benefits.

3. One recent study concluded that “Recycling can significantly reduce primary demand, especially for batteries, however it cannot meet all demand and there is a time delay for when recycled metals become available.”[2] Do you agree that recycling alone cannot meet global demand for critical minerals?

I absolutely agree with that conclusion to the extent it applies to all critical materials needed to manufacture lithium-ion automotive batteries worldwide. In fact, it will be decades before lithium-ion recycling can provide a significant percentage of all critical minerals needed for lithium-ion battery production. Until that time, the battery industry will be dependent upon obtaining virgin critical materials from traditional mining in order to supply what is expected to be accelerating demand for electric vehicles.

I would offer, however, two caveats to my general answer. The first relates to cobalt, which is perhaps the most worrisome critical mineral used in lithium-ion automotive batteries, because of its limited physical supply and tenuous supply chain. For a number of reasons, lithium-ion batteries used in consumer electronics devices contain a much higher percentage of cobalt than batteries used in electric vehicles. Moreover, many battery companies are working hard to develop new automotive batteries that will sharply reduce the amount of cobalt needed. So cobalt generated from the recycling stream of all lithium-ion batteries might constitute a significant percentage of the cobalt needed for new automotive batteries sooner than expected.

My second caveat concerns the important question of where those virgin critical minerals are going to come from. As noted in my original testimony, the United States is quickly becoming a third or fourth tier player in lithium-ion battery manufacturing. Today about 75% of lithium-ion batteries are manufactured in China, which understands the strategic importance of lithium-ion technology and has invested relentlessly in it.

While demand for energy materials needed to supply battery manufacturers worldwide is expected to grow dramatically over the next decades, it is questionable whether U.S. miners and energy materials manufacturers will be able to take advantage of this growth in the absence of a robust domestic lithium-ion battery manufacturing base. Energy materials mined in the United States are likely to be costlier than those mined in less developed countries, particularly if transportation costs must be added on. And Chinese manufacturers will likely always view U.S. energy materials as coming with undesirable geopolitical risk. Significant demand for U.S. energy materials will materialize only if significant domestic demand for those materials materializes.

I fully endorse and applaud the efforts of those in the U.S. Senate who are acting to encourage the expanded mining of energy materials in the United States. But as any farmer will tell you, it’s a bad idea to buy half a cow.

Ranking Member Carper:

1. During the hearing, it was mentioned in testimony that China and European countries are not only leading the world in electric vehicle sales, they are also leading the world in battery recycling. It is my understanding that the European Union has mandated that electric vehicle batteries be built to be more recyclable and is requiring that automakers recycle them. Soon, China will have laws in place that require automakers to be responsible for recycling the batteries in electric vehicles as well.

(a) Would mandates similar to what is occurring in China and the European Union make sense here in this country? If not, why not? If yes, please explain further.

As mentioned in my answers above, industry’s great hope is that direct recycling technology, which will theoretically produce high value, fully formed cathode material that can be used directly in new batteries, can be made to work economically at scale. If direct recycling can be made to work, such that recyclers can put out a “pull signal” for lithium-ion batteries and rely on the free market to ensure their collection, the problem of lithium-ion battery recycling, and the need to require it through regulation, might largely go away. It is far from clear, however, that direct recycling technology can be made to work at scale.

My recommendation is that Congress fully support further research into direct recycling technology in the near term. Congress should require a report from the U.S. Department of Energy within three years as to the status of direct recycling technology and whether a commercial market for that technology is likely to develop in the near term, which will allow recyclers to buy used lithium-ion automotive in the marketplace rather than requiring a tipping fee to perform recycling services. If direct recycling technology has not made major progress in the next three years, Congress should consider implementing a national program to recycle lithium-ion automotive batteries. I believe that a highly modified extended producer liability program will probably prove the most efficient way to do this.

(b) Are there other examples of electric vehicle battery recycling requirements or best practices occurring in other countries or in the states in this country that could and should be implemented at the federal level in the United States?

I am unaware of any recycling programs outside of China and Europe focused on lithium-ion batteries. I would, however, draw to the Committee’s attention to the fact that the United States has a unique concern to address with respect to lithium-ion battery recycling: the need to maintain domestic control of the energy materials generated by lithium-ion battery recycling.

Today, with the exception of battery cells made by Panasonic at the Tesla Gigafactory in Nevada, almost no lithium-ion battery cell manufacturing takes place in the United States at scale. This needs to change for many reasons. But any future U.S.-based manufacturer will need access to energy materials in order to grow to scale. One possible source of energy materials are those generated by recycling lithium-ion batteries used in the United States. The federal government should consider protecting those energy materials as a national resource.

There is a risk that incumbent lithium-ion battery manufactures, who are largely Asian-based, will use their current market position to require their U.S. customers to return lithium-ion batteries and/or the energy materials they contain to the foreign manufacturer at the end of life. Any such requirements could hamper the efforts of future U.S.-based lithium-ion battery manufacturers to gain access to energy materials and grow to scale.

(c) Should the U.S. look to any countries besides those in the European Union or China

I am unaware of programs in any other countries that would provide possible guidance on this question.

2. Are federal investments in our nation’s entire recycling infrastructure needed sooner than later? If yes, what should those investments look like? If not, why not?

The only critical federal investment needed at this time is research and development funding for direct recycling technology. If direct recycling technology can be made to work economically at scale, a good part of the lithium-ion battery recycling problem goes away and can be addressed by the free market without the need for significant government investment or regulation. We should know the answer to the question of whether direct recycling technology will work at scale fairly soon.

The good news about lithium-ion battery recycling is that we do not have a recycling crisis, at least not yet. Looking ahead it is easy to see that there may be a crisis in the future. But we still have some time to explore possible technology solutions and, if those solutions do not pan out, to design a recycling system that minimizes compliance costs and does not stifle battery innovation.

In a sense the best thing the federal government can do at the moment is to slow things down and see what happens over the next few years. The worst outcome would be 50 sets of potentially inconsistent state recycling regulations that would increase the cost of electric vehicles and potentially stifle lithium-ion battery innovation in order to address a problem that has not yet quite arrived.

3. You discussed in your testimony economic issues facing the recycling industry with respect to batteries. Name three critical policies Congress should focus on today to overcome these economic issues and ensure electric vehicle batteries are recycled in a safe and proper manner in this country in the near future.

A. Congress should fully fund efforts to develop direct recycling technology for lithium-ion batteries and determine its economic efficacy at scale. As previously stated, this technology, if successful, could fundamentally change the lithium-ion battery recycling problem and allow lithium-ion batteries to be recycled in the same successful way that lead-acid batteries are recycled today.

B. Congress should pre-empt the desire of states and localities to regulate the recycling of lithium-ion automotive batteries, understanding that the principal motivators of any recycling program will be national concerns about greenhouse gas emissions and domestic supply of energy materials, rather than public health and safety issues more suitable for state and local regulation. National regulation of lithium-ion automotive battery recycling will help keep the cost of electric vehicles low and speed the transition to electric drive.

C. Congress should prohibit the export of used lithium-ion automotive battery packs, modules and cells and the export of any energy materials produced by lithium-ion battery recyclers. All such energy materials should be reserved for manufacturers who will use them to make new lithium-ion battery products in the United States.

4. In terms of electric vehicle battery recycling, do you believe the federal government should be more focused on finding a second life for electric vehicle batteries or finding a second life for the substances and materials that make up the electric batteries? Please explain.

Both are important. There is really no choice for the government to make here, as the recycling and reuse of the substances and materials that make up electric batteries will eventually take place following their second life use in the same way that it will take place following their first life use, if no second life use is found.

Finding a second life use for automotive lithium-ion batteries would be an important tool to lower the effective cost of electric vehicles by providing their owners with an opportunity recoup money from a vehicle at the end of its battery’s useful life in the owner’s car. It is clear that at the end of most batteries’ useful life in an automotive application, the battery will have sufficient remaining capacity to power other sorts of systems before the battery degrades to the point where recycling is the only option. Several companies are looking at possible second life uses for automotive batteries, including storing electricity on the grid, in businesses and in homes, using them as UPS resources, and using them to buffer EV charging stations.

There are three basic challenges to second life use of automotive batteries. The first concerns the potential product liability of auto manufacturers for the use of batteries in a second life application. Lithium-ion automotive batteries are high voltage systems that are inherently dangerous. Many auto makers are discouraged from supporting the second life use of the batteries originally installed in their cars for fear that the liability arising out of any accident connected with the second life use will be lodged with the auto maker, even if the auto maker is not involved in the second life application. Greater clarity concerning whether and to what extent an auto maker or battery maker can be held liable for accidents occurring during the second life of a battery unrelated to its original use and purpose would be helpful.

The second challenge involves the cost of transporting and repurposing used automotive batteries for second life applications. Since a customer considering the use of a second life battery will always have the option of buying a new battery instead, the price of transporting and repurposing the used automotive battery will be relevant to the customer’s purchase decision. Since the public interest would be served by extending the useful life of automotive batteries through second life use if possible, the federal government could play a helpful role by ensuring that the costs of transporting and storing second life automotive batteries are not higher than they need to be. Specifically, the federal government should ensure that the regulatory requirements for transporting and storing second life automotive batteries are no more stringent than the requirements for transporting and storing both new batteries and batteries consigned for recycling. It is not clear that this is now the case.

Finally, the third challenge, somewhat related to the second, is that the cost of second life batteries, including the necessary costs of repurposing those batteries for the intended second life application, will always be in competition with the cost of new lithium-ion batteries, which continue to fall. There may come a time when, because the cost of repurposing an automotive battery for second life, it simply makes no sense to not buy a new battery instead. Time will tell and the market will decide whether second life batteries can compete with new batteries. The best and only thing the federal government should do is ensure a level playing field between the options.

Senator Whitehouse:

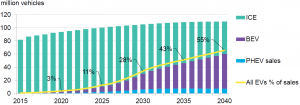

What is your best estimate for the number of EVs on the road globally by 2040? Please give numbers stated clearly as total number of vehicles, as a percentage of total vehicles, and as a percentage of new vehicle sales in 2040 to aid comparison between estimates. Please also give a breakdown of estimates by type of vehicle if possible (e.g. light vehicles, buses, heavy vehicles).

Any estimate of what the number of EV sales will be in 2040 is highly speculative. Several new technologies will be developed and commercialized over the next 21 years that will impact, perhaps significantly, the number and character of vehicles that will be sold in 2040. Some of those technologies may be unknown today.

Attached below is a chart presented by BloombergNEF at a recent industry conference, which provides many of the estimates your question requests. BloombergNEF is a well-respected market research firm. The estimates I have seen provided by other research firms covering same area do not vary materially from the numbers provided by BloombergNEF:

I would take one exception, however, to BloombergNEF’s estimate: I believe the slope of adoption of BEV’s shown on the chart is wrong. Historically, when a major technology change occurs in the transportation sector, and a new technology proves itself superior to incumbent technology, the change over to the new technology is sudden, dramatic and nearly complete. BloombergNEF’s prediction of a gradual increase in the number of BEV sales through 2040 does not square, in my view, with how the transportation sector historically reacts to the introduction of a new, superior technology.

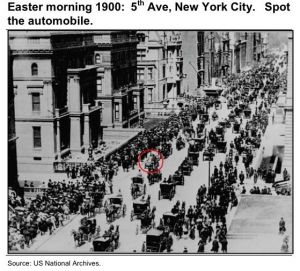

A better illustration of the rate of adoption of new technologies in the transportation sector can be seen in the following images:

|

|

I do not know and cannot predict when or whether the market will recognize electric drive as a technology superior to the combustion engine. But there are many reasons to believe that time may be coming soon. The U.S. industrial base is woefully unprepared for what will follow if and when it comes.

# # #

[1] See discussion of shut downs of lead acid recycling plants in California by the California Department of Toxic Substances Control at https://dtsc.ca.gov/exide-home/

[2] E. Dominish, et al., “Responsible Minerals Sourcing for Renewable Energy” (2019), prepared for Earthworks by the Institute for Sustainable Futures, University of Technology Sydney, available at: https://earthworks.org/cms/assets/uploads/2019/04/MCEC_UTS_Report_lowres-1.pdf.